How is the Grocery Store Footprint Changing?

How is the Grocery Store Footprint Changing?

Online shopping may be growing in popularity, but when it comes to groceries, old shopping habits die hard. Most customers still make trips to physical stores to pick up their food. But whereas the majority of consumers used to make one big trip to a supermarket per week, today’s shoppers don’t mind stopping in multiple times a week to pick up fresh ingredients or ready-made food. This shift, combined with the rise of online platforms, are drastically altering how grocers do business.

The 2018 U.S. Grocery Tracker report from JLL noted that “grocers are focusing on online shopping, grocery delivery, and click-and-collect digital platforms.” As the online presence of stores get bigger, the physical store footprints are shrinking, and retailers’ priorities are changing. Grocers are now constantly looking for ways to reduce operational costs and identify new investments that will improve the customer experience.

Grocery Stores Get Smarter and Smaller

The trend of smaller retail store designs isn’t ubiquitous—many stores in rural areas remain larger and act as supercenters. However, closer to urban areas, limited physical space and expensive real estate have combined to force retailers, and especially grocers, to think creatively. While the average size of a grocery store clocked in around 40,000 square feet a few years ago, many modern outlets are under 20,000 square feet—with some, such as Trader Joe’s and Aldi, regularly measuring closer to 12,000.

Even traditionally larger grocers like Whole Foods are testing new concepts centered around the smaller store footprint. Whole Foods Market 365 features lower prices, smaller spaces (about half the size of a typical Whole Foods) and digital pricing capabilities. The idea is to appeal to those customers who are making several quick shopping trips per week to pick up fresh of prepared foods.

Target is trying to appeal to this same demographic in its testing of smaller stores. It launched its small format stores in 2012, with the bulk of these locations found in densely packed urban areas. Then in 2014, the brand started TargetExpress, which were small format stores that only covered about 15% of a typical Target outlet. The space is designed for quick shopping trips, with smaller baskets and checkout lanes optimized for higher traffic. Faster checkout is also a theme with grocers such as Kroger, which has plans to test scan-and-go technologies.

A frictionless checkout experience will be much tested in the future. According to NCR, 73% of consumers think the checkout line is the biggest pain when shopping, and as much as one-fifth of customers will abandon their items if the checkout lines are too long. To speed up the process, retailers are experimenting with tech such as mobile checkout. A similar method is on display with Amazon Go. Those stores use a combination of sensors and deep learning, tracking when items are taken from shelves with the help of a mobile app. When a customer is done shopping and leaves the store, Amazon Go charges their account and sends a receipt—no lines, no scanning and no waiting.

The Digital Ceiling in the New Age of Retail

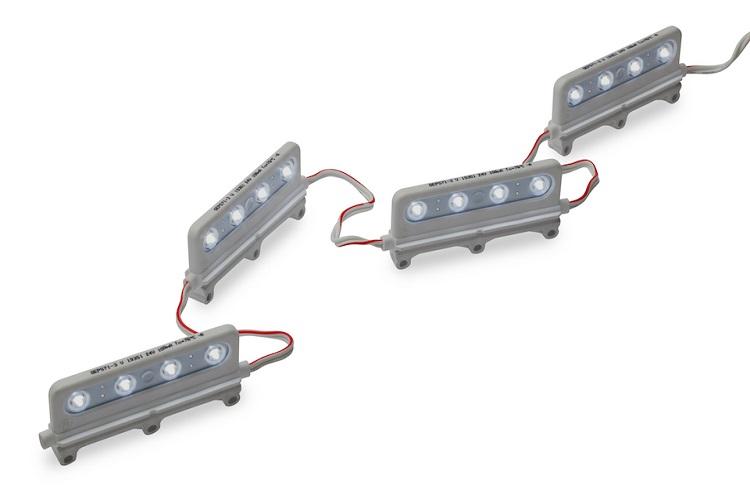

This type of forward-thinking smart store design will be essential for success. As grocery stores shrink, how they use the limited space they have becomes even more important. That starts with illuminating the space efficiently and strategically: For example, LED lighting in the produce section can help grocers show off the quality of their goods. The brighter light can bring out the colors in natural foods, increasing their appeal and helping shoppers choose the freshest items. This type of environment could hook customers who value high-quality goods and encourage them to return to the store.

Smart stores can even use a digital ceiling to help manage refrigeration needs. An Internet of Things (IoT) platform can integrate sensor-enabled lighting with HVAC and refrigeration systems. The sensors can track the temperature of refrigerated displays, for example, and alert managers when the temperature is outside of the ideal range. That can ultimately prevent spoilage and decrease food waste, while also keeping heating and cooling costs to a minimum. A platform providing this type of centralized management—regardless of the legacy technology in use—will go a long way toward further reducing energy costs.

Customer priorities have been and will continue to be the focus for grocers. Not only does that mean highlighting high-quality fresh foods, but it also will consist of personalizing the shopping experience for everyone. A digital ceiling can help in this regard. The same IoT platform that reduces can integrate data from sensors and other IoT devices to deliver data aggregation. Data can then support new types of solutions to better understand people movement, deliver unique offers and promotions to customers in the aisle, understand the path to purchase, and how to optimize the merchandise plan and inventory based on the demographics of customers. To help retailers to understand the customer, the smart store is an environment that can connect to all channels to provide a unified commerce strategy, satisfying customers at every turn.

Smart ceilings can also help retailers optimize different sections of a store for various tasks. For example, while many traditional supercenters will remain large, a few are testing new uses of space. What once may have been a huge expanse of retail space is now being split into the sales floor and distribution center. Buildings then need different lighting to create the optimum environment in each section. When those fulfillment centers are equipped with sensor-enabled smart lighting, stores can more easily keep track of inventory, increasing the efficiency of delivery services and ensuring that out-of-stocks are minimized.

This is just a glimpse of the future of smart grocery stores. Retailers who are willing to get smarter regarding their space utilization and store footprints, customer experience and energy usage can tap into a new market of shoppers and compete with online channels, but first they must invest in the right digital infrastructure.